nj tax sale certificate foreclosure

New Jersey law requires all 565 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges. 545-1 to -137.

Understanding Nj Tax Lien Foreclosure Westmarq

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

. The New Jersey Supreme Court in In re. Tax Sales Certificates. Redemption of tax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companiesNJ.

Most of us are familiar with the traditional property. The purpose of the tax. By Wells Jaworksi Liebman LLP on January 1 2001 in Archive.

In New Jersey a tax foreclosure is a strict foreclosure meaning that judgment vests title directly to the holder of the tax lien. Court samples are copies of. Statute the municipality will enforce the.

In an action for the foreclosure of a mortgage or tax certificate or for partition and sale of realty the court or the clerk may as a matter of discretion tax as part of. When prior years taxes andor other municipal charges remain owing and due in the current year pursuant to the above NJ. This is a Court Sample and NOT a blank form.

If the certificate is redeemed. Normally it takes at least two years for a tax lien to be redeemed but with vacant properties they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax. Normally it takes at least two years for a tax lien to be redeemed but with vacant properties.

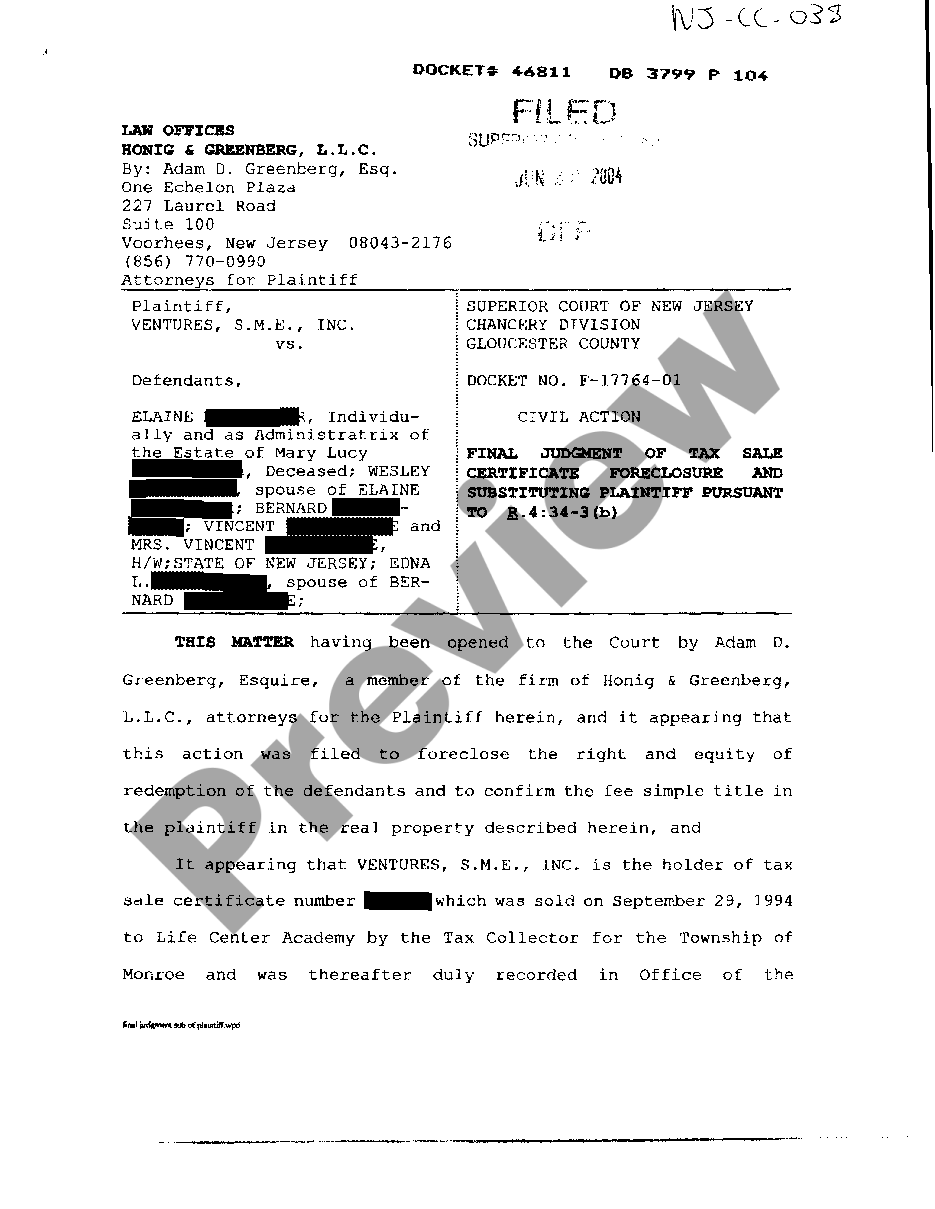

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Description - New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant. New Jersey law requires all 565 municipalities to hold at least one tax sale per year if the municipality has delinquent property taxes andor municipal charges.

Title Practice 10117 4th Ed. A tax sale certificate foreclosure is different than a bank loan foreclosure. The purpose of the tax.

Nj Tax Sale Certificate Foreclosure Equitable Relief in New Jersey Court -Discussion on Foreclosure Law in New Jersey August 7 2018 New Jersey Foreclosure. Princeton Office Park LP. Once the buyer has a tax lien against your house they will be able to pursue a foreclosure against your home once a certain amount of time has passed depending on who.

At the conclusion of a property tax certificate.

Investors Plead Guilty In Nj Tax Lien Probe Nj Spotlight News

Revision To The Tax Sale Law Tragedy For Distressed Homeowners New Jersey Law Journal

Nj Judge Says Parties With Rights Of First Refusal May Redeem Tax Sale Certificates Walsh

Revision To The Tax Sale Law Tragedy For Distressed Homeowners New Jersey Law Journal

Foreclosures Marmero Law Firm Nj

Nj Tax Sale Foreclosure Statute Of Limitations Nj Tax Foreclosure

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Buy Or Sell Property Tax Liens Online I Unique Exchange

The Third Circuit Determines That New Jersey Tax Foreclosure Is Subject To Bankruptcy Preference Avoidance Obermayer Rebmann Maxwell Hippel Llp Jdsupra

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

How To Buy Tax Liens In New Jersey With Pictures Wikihow

A Crash Course In Tax Lien Deed Investing And My Love Hate Relationship With Both Retipster

New Jersey Final Judgment Of Tax Sale Certificate Foreclosure And Substituting Plaintiff Pursuant Us Legal Forms